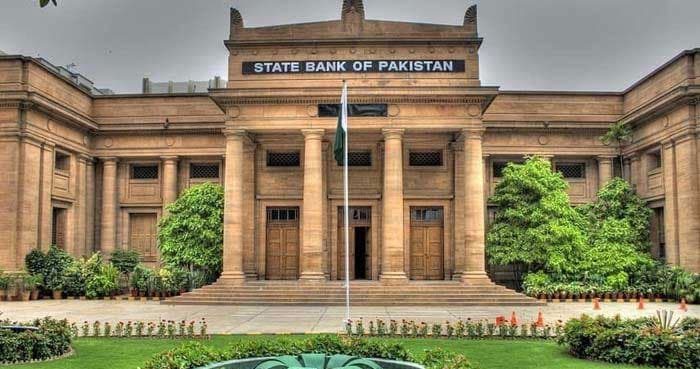

ISLAMABAD: The State Bank of Pakistan (SBP) has announced significant amendments to the minimum rate of return (MPR) requirements and guidelines for Islamic banking. From January 1, 2025, MPR will not apply to financial institutions, public sector enterprises, and public limited companies.

Additionally, Islamic Banking Institutions (IBIs) will now have to pay at least 75% of the weighted average gross yield from their investment pool as profit on PKR Savings Deposits.

Earlier, banks were mandated to pay an MPR on all Pak Rupee savings deposits, which is set at 50 basis points above the current SBP repo rate. The change has been viewed positively by industry experts, as it is expected to reduce deposit costs for banks.

The amendments will particularly benefit banks with a high proportion of corporate deposits, allowing them to negotiate rates directly with corporate clients.

The State Bank has also revised the profit sharing framework for IBIs. The new guidelines mandate that IBIs must calculate returns on their PKR savings deposits based on the average gross yield of their investment pool, excluding certain assets. The aim of the adjustment is to enhance transparency and ensure competitive return distribution for depositors.

These changes reflect State Bank’s commitment to strengthen the Islamic banking framework and promote ethical finance in Pakistan.